Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out hair stylist tax deduction?

1. Gather the necessary documents: You will need records of all income received from your clients, as well as receipts for expenses related to your business.

2. Determine your business entity: You will need to determine if you are filing taxes as a sole proprietor, partnership, LLC, or another type of business entity.

3. Research eligible deductions: You will need to research the IRS publication for hair stylists to determine what expenses are tax-deductible.

4. Calculate your taxable income: You will need to calculate your total income minus all of your eligible deductions to determine your taxable income.

5. File your taxes: Once you have calculated your taxable income, you can file your taxes with the IRS. Be sure to include all of your deductions and other information required on the appropriate forms.

What is the purpose of hair stylist tax deduction?

The purpose of a hair stylist tax deduction is to allow hair stylists to deduct certain business expenses from their taxable income. These expenses can include the cost of supplies, equipment, and advertising, as well as mileage and travel costs related to their job. By taking advantage of this deduction, hair stylists can reduce their taxable income and save money on their taxes.

What information must be reported on hair stylist tax deduction?

Hair stylists may be able to deduct the cost of business-related expenses such as supplies, tools, and equipment, advertising and marketing expenses, educational costs, business travel expenses, salon rental fees, and other business-related expenses. These expenses must be reported on Schedule C of the IRS Form 1040. In addition, hair stylists may be able to deduct certain business-related expenses as itemized deductions on Schedule A of the Form 1040. These deductions may include health insurance premiums, union dues, and professional liability insurance premiums.

When is the deadline to file hair stylist tax deduction in 2023?

The exact deadline for filing hair stylist tax deductions in 2023 will depend on the particular tax situation of the filer. Generally speaking, the deadline for filing taxes in the United States is April 15th of the following year. To be certain, it is best to consult with a tax professional.

What is hair stylist tax deduction?

Hair stylists, like other self-employed individuals, may be eligible for various tax deductions related to their business expenses. Some common hair stylist tax deductions include:

1. Salon rent: If you rent a space in a salon or lease a building for your own salon, you can deduct the rental or lease expenses as a business expense.

2. Supplies and products: The cost of hair care products, equipment, tools, and supplies used in your daily work can be deducted. This includes things like scissors, hair dryers, styling products, and hair coloring products.

3. Continuing education: If you attend seminars, workshops, or other educational programs to enhance your skills and knowledge as a hair stylist, the expenses related to these programs can be deducted.

4. Business insurance: Premiums paid for liability insurance or other business-related insurance policies can be deducted as an expense.

5. Uniforms or work attire: If you purchase and maintain uniforms or specific clothing for work, these expenses can be deducted.

6. Advertising and marketing costs: Expenses related to advertising your hair styling business, such as business cards, flyers, website development, and social media promotions, can be deducted.

7. Professional association dues: Membership fees for professional associations or organizations related to the hair styling industry can be deducted.

It is important to keep detailed records and receipts of all your business expenses to properly claim these deductions. Consulting with a tax professional or accountant is recommended to ensure you are maximizing your eligible deductions and complying with tax laws.

Who is required to file hair stylist tax deduction?

Hair stylists, also known as hairdressers or cosmetologists, are self-employed individuals or independent contractors who are typically required to file a tax return and report their income. They can claim various tax deductions related to their hair styling business. However, the specific tax deductions that can be claimed may vary based on the country and tax laws. It is recommended for hair stylists to consult with a tax professional or accountant to determine the eligible deductions and ensure compliance with tax regulations.

What is the penalty for the late filing of hair stylist tax deduction?

The penalty for late filing of hair stylist tax deduction varies depending on the jurisdiction and tax regulations in place. In general, penalties for late filing of taxes can include fines, interest charges, and late payment penalties. These penalties may increase over time the longer the tax return remains unfiled. It is advisable to consult with a tax professional or refer to the relevant tax authorities to understand the specific penalty structure for late filing in your area.

How do I make changes in hair stylist tax deduction worksheet pdf?

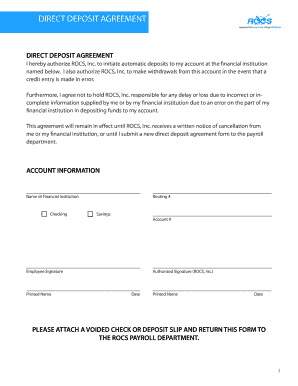

With pdfFiller, the editing process is straightforward. Open your hair stylist tax deduction worksheet form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit hair stylist tax deduction checklist pdf in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing hair stylist expense sheet and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the salon tax worksheet electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your cheat sheet hair stylist tax deduction worksheet form and you'll be done in minutes.